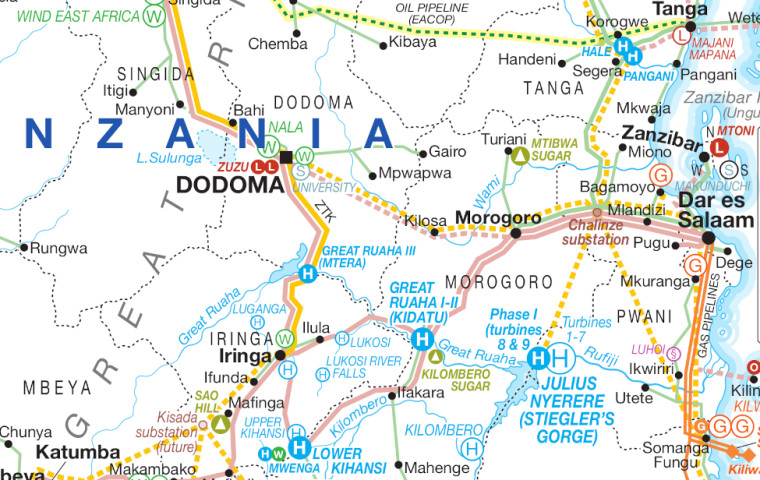

In every country and region of Africa the addition of more transmission capacity will open new IPP opportunities, allow more wind and solar to be added, will stimulate trade making generation projects more bankable, and of course will bring power to more businesses and people, improving lives and stimulating economic growth. Detailed planning, better financial models, and improved regulation are finally being put in place at utility, power pool and multilateral institution level. The test is whether serious money will follow.

African Energy is following what could be the single most important phase of African power markets development.

Issue 504 - 22 April 2024

Issue 502 - 14 March 2024

Issue 502 - 05 March 2024

Issue 501 - 26 February 2024

Issue 500 - 11 February 2024

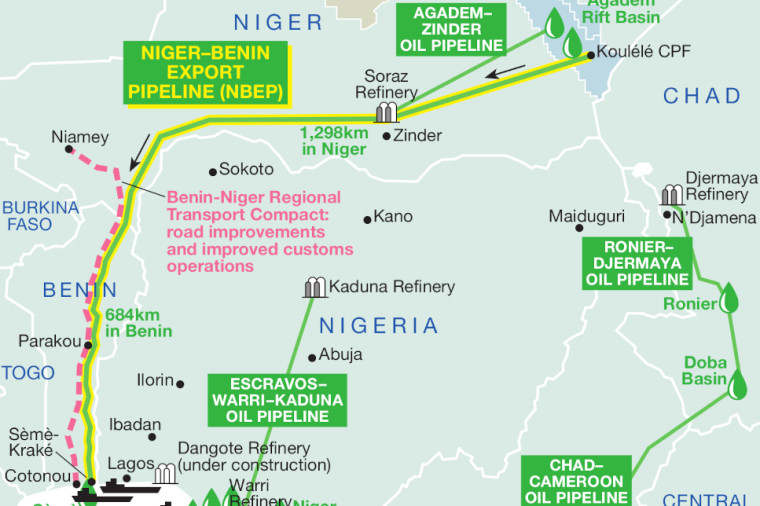

The decision by the military regimes governing Burkina Faso, Mali and Niger to leave the Economic Community of West African States (Ecowas) has new implications for regional stability and the fight against jihadism in the Sahel.

The military leaders had all previously promised ‘transition’, to include elections. But now these juntas, struggling to combat jihadist and separatist insurgencies following their ejection of French and EU forces, have increasingly looked to Moscow and its military ‘advisors’ as to retain their hold on to power. Russian firms, including the Wagner Group – now rebranded as the ‘African Corps’ – have shown interest in the region’s resources and complicated questions over regional energy interdependence remain to be answered.

Issue 504 - 21 April 2024

Issue 504 - 21 April 2024

Issue 499 - 04 February 2024

Issue 499 - 04 February 2024

Issue 495 - 15 November 2023

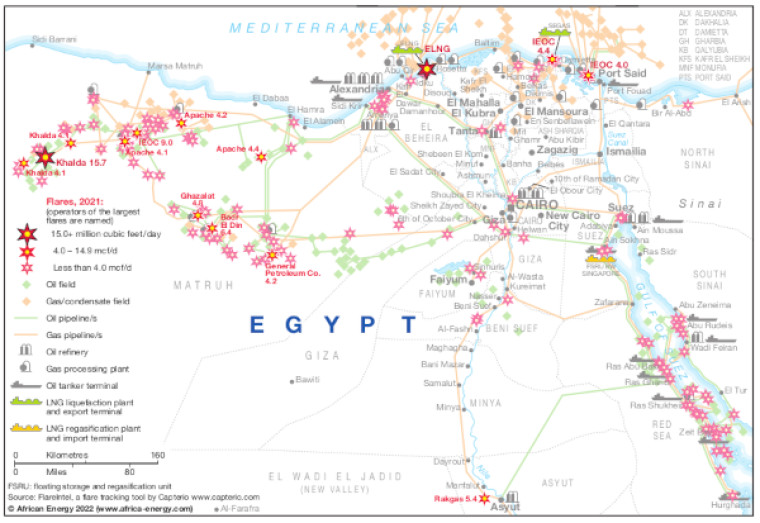

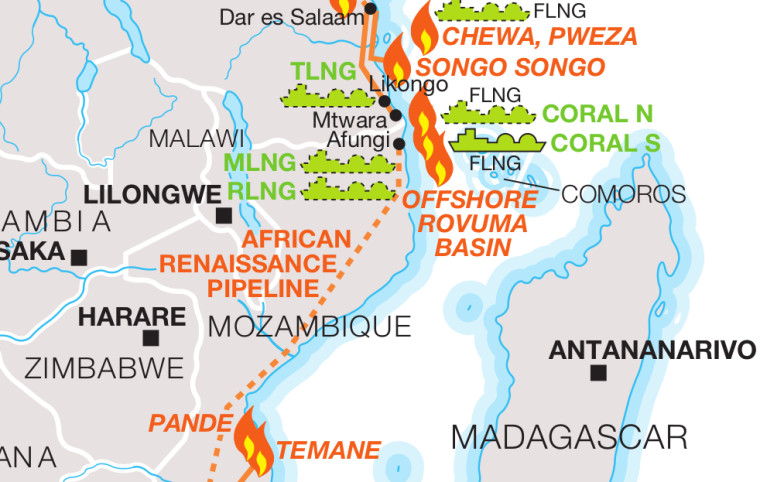

A sustainable future for the continent is necessarily based on renewable energy and storage solutions as the world heads towards net zero carbon emissions by 2050 but in Africa gas still has a role to play.

A global policy framework driven by the dominant economies of the world may not be what African people and economies need as they strive to shift from dependence on coal, heavy fuel oil, diesel and polluting cooking fuels. African Energy follows the debates and the developments.

Issue 503 - 07 April 2024

Issue 503 - 20 March 2024

Issue 502 - 17 March 2024

Issue 502 - 17 March 2024

Issue 502 - 17 March 2024

Green hydrogen (GH2) prospects in Africa are developing at breakneck speed. But the biggest questions remain unanswered.

Issue 502 - 12 March 2024

Issue 501 - 03 March 2024

Issue 501 - 29 February 2024

Issue 501 - 29 February 2024

Issue 489 - 03 August 2023