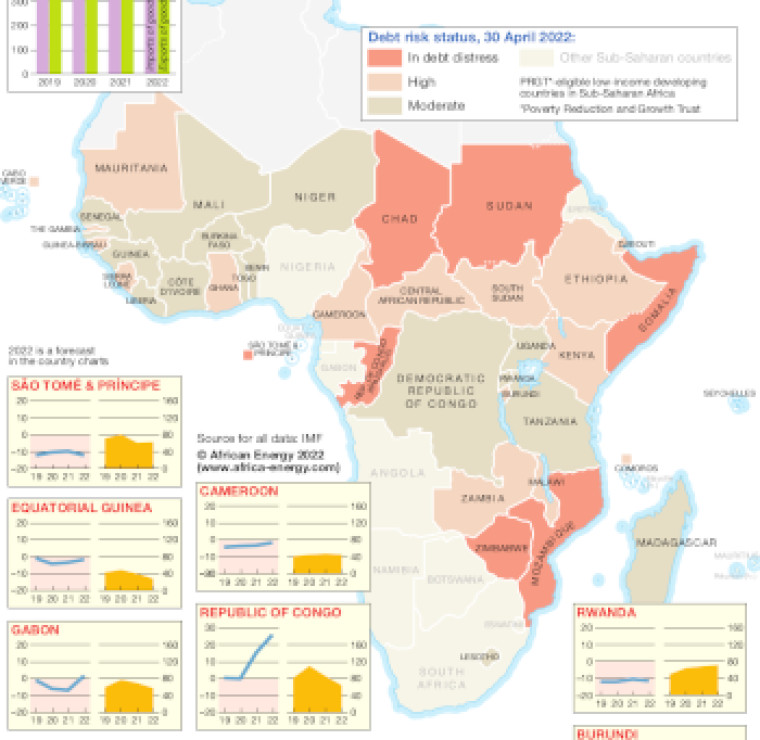

Surging prices for wheat, oil and other commodities are placing strain on individuals, businesses and governments, with an increasing number of sub-Saharan countries now classed as ‘debt-stressed’. Defaults may be avoided this year, but ‘food riots’ could flare up. Yet commodity exporters may profit as the energy transition and geopolitical shifts present opportunities for everything from natural gas to transition minerals, writes Marc Howard, with African Energy staff.

Extra Large Article

£595

(Access to one African Energy article)

Subscribe to African Energy