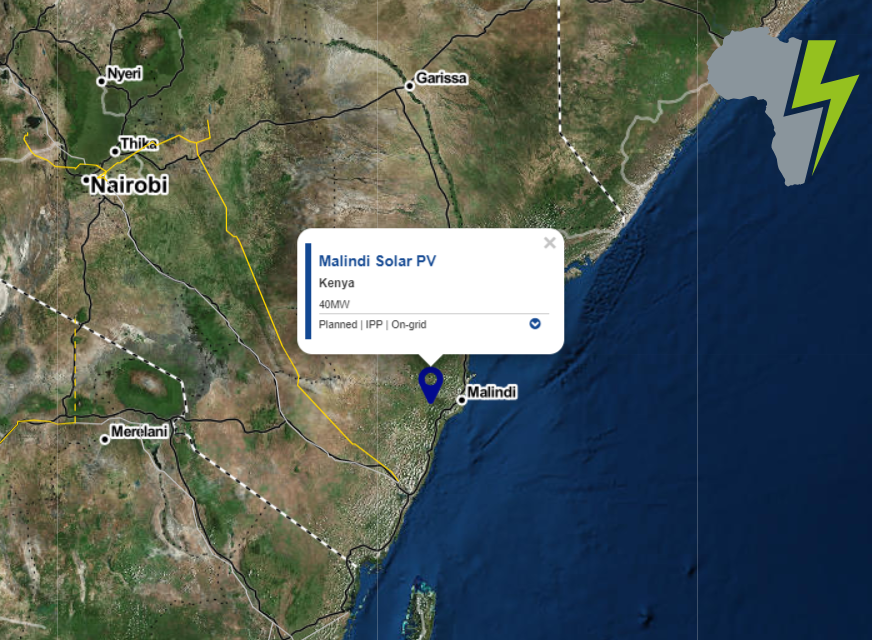

United Kingdom-based developer Globeleq announced on 3 June that the 40MWac Malindi solar photovoltaic (PV) project in Langobaya in Malindi District, Kenya, has reached financial close. India’s Sterling and Wilson is the engineering, procurement and construction contractor for the plant, which is expected online in mid-2020.

Globeleq acquired 90% of the project in 2017, with the remaining 10% held by the original developer Africa Energy Development Corporation (AEDC). AEDC’s partner Investment and Development of East Africa Power Group (Idea Power) sold its stake at financial close. A $52m debt package for the project has been arranged by one of Globeleq’s parent companies, CDC Group, and includes $20m from German development bank DEG (AE 374/8).

There had been optimism that financial close would be reached in the first half of 2018 following the signing of a power purchase agreement (PPA) alongside three other projects in July 2017, but the signing was delayed (AE 370/4). Frontier Investment Management’s Eldosol and Radiant projects, which are backed by the Netherlands' FMO and the European Investment Bank, reached financial close in March and are under construction. Alten Energias’ Kesses is experiencing delays.

Two other solar projects have subsequently signed PPAs: Voltalia at Kopere and Kenergy, Scatec Solar and Norfund at Rumuruti. All solar projects with PPAs are 40MWac.

Globeleq completes South African acquisitions

On 29 May, Globeleq announced that it had completed the acquisition of four renewable power plants from New York Stock Exchange-listed Brookfield Asset Management in South Africa: 11MW Aries, 11MW Konkoonsies and 31MW Soutpan, all solar PV, and the 27MW Klipheuwel wind power plant. The transaction was first made public in July last year and also included 33MW Witkop and 66MW Boshoff solar projects. Globeleq expects to close the purchase of Boshoff in the next few weeks.

Brookfield had previously acquired stakes in the projects from SunEdison’s then-yield company Terraform Global, which split dramatically from its parent company in 2017.

Globeleq aims to improve operations as well as social and economic development programmes associated with the plants. This may include the possibility of lowering tariffs. All six projects were developed in the first two rounds of South Africa’s renewable energy independent power producer procurement programme in which the high cost of tariffs compared with subsequent rounds has become a political issue, as different political factions have sought to shift the blame for the disastrous performance of national utility Eskom.

Standard Bank acted as the sole mandated underwriter and arranger for the transaction debt facility.

Find a power plant on our database or tell us about your project