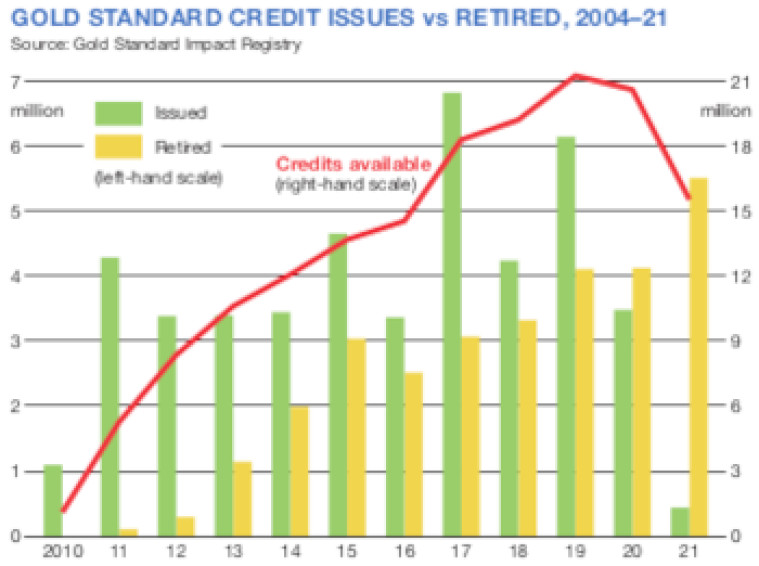

Demand for voluntary carbon credits from Africa has risen sharply over the past decade, but in recent years the supply of new credits has fallen away. Developers blame a complex and fragmented marketplace, with numerous credit certifiers, exchanges, brokers and aggregated funds making it challenging to navigate.

Tagged with:

Subscribe to African Energy

As part of African Energy’s research into climate and energy transition finance, we want to hear your experience of the carbon and renewable credit markets. We are seeking to understand how much of the voluntary carbon market – estimated by the World Bank Group to be worth $1bn in 2022 – is from credits issued from African projects and the challenges buyers and sellers face.

Whether you are offsetting emissions or issuing credits from projects, we want to hear about your experience.