Decarbonisation programmes being drawn up at Eskom and Sasol have the potential to drastically alter the energy landscape in South Africa and Mozambique, potentially catalysing investment in gas infrastructure and offering new opportunities in renewable energy, green hydrogen, and sustainable aviation fuel.

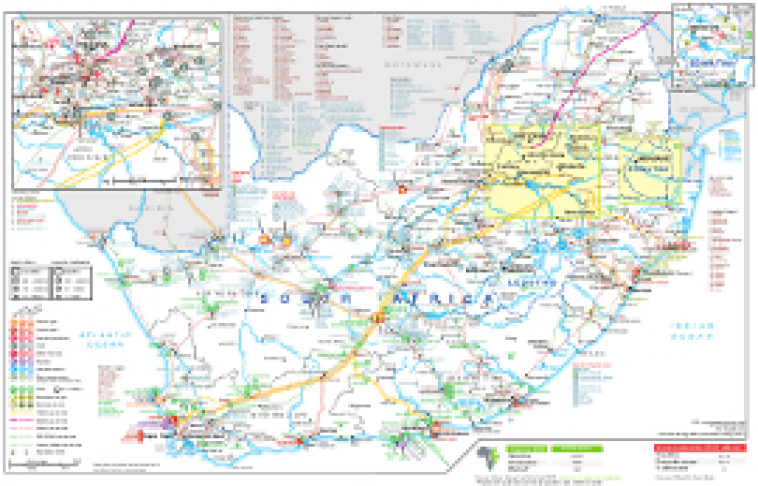

It is not yet clear where, in a changing South African gas supply landscape, the government and IPP Office will choose to site the 3GW of gas capacity that is scheduled to be tendered to independent power producers (IPPs) at end-year or, more likely, in 2022.

Previous plans had involved 1GW plants at Coega, Richards Bay, and Saldanha Bay, all supplied by FSRUs. However, those projects never made it past the planning stage and recent experience with Karpowership shows the challenge of bringing LNG into South African ports through an IPP programme.

While industry awaits more information on the programme, attention is on the two heavy polluters – Eskom and Sasol – as the likely anchor demand for investment in gas infrastructure. The energy sector accounts for 55% of South African greenhouse gas (GHG) emissions, mostly from Eskom’s coal and peaker plants.

In 2017, Sasol’s energy businesses released 63.9m tonnes of GHG into the atmosphere – 99.5m tonnes if downstream (scope 3) emissions are counted – with a further 3m tonnes emitted by its chemicals business.

Eskom’s decarbonisation plans are highly contingent on raising funding internationally and while the utility told African Energy that gas would certainly feature in its plans, many regulatory, legal and financial questions remain to be resolved. There is no doubt that to rebuild its generation capacity, and continue to fulfil its anchor role in electricity supply, Eskom will need gas, but delays are likely.

Sasol is much more advanced in its transition plans, announcing on 22 September that it was tripling its targets for GHG emissions reductions to 30% from 2017 levels by 2030 (20% for downstream scope 3 emissions). As its asset disposal programme winds down, Sasol is ‘aggressively pursuing’ opportunities in the energy transition, which it believes it is uniquely positioned to address.

Gas is central to the chemical giant’s plans as a transition fuel and comprises the biggest chunk of GHG emissions reductions, followed by energy efficiency and then renewable power. Sasol intends to replace 10m t/yr coal with gas by 2030 and said it will no longer invest in new coal resources. This will mean increasing supply by 40-60m GJ/yr by the end of the decade. Sasol and the Central Energy Fund (CEF) on 7 September signed a memorandum of understanding to increase gas supply.

Vice president energy Priscillah Mabelane said Sasol was in advanced negotiations with the Matola FSRU project over a term sheet to secure LNG for Rompco (see above), and was looking at LNG supply into Richards Bay, which would take longer. Sasol is working with the CEF and government to speed up the process, to give security of supply and provide competition for LNG supply.

Gas supply will be increased in a phased manner as Sasol does not want to lock in gas as a feedstock over the long term if lower emission alternatives emerge. Gas is significantly more expensive than coal as a feedstock for synthfuels, but even so Sasol forecasts that its fuels will break even at $30-35/bbl by 2025. Its chemicals business in South Africa is expected to take a significant hit to competitiveness, although Sasol’s international chemicals business is expected to grow rapidly following the commissioning of its giant Lake Charles facilities.

Promoting its renewables ambitions, Sasol has already signed a power purchase agreement to supply a green hydrogen electrolyser, which is scheduled to begin operating by 2023. A further 600MW is set to be procured by 2025 (AE 436/13) and another 600MW by 2030, to be wheeled over the grid.

Mabelane said many projects responding to Sasol’s tender are “shovel-ready”, but Sasol was concerned that transmission is constrained in Northern Cape, given the electricity price sensitivity of Sasol’s power-to-x projects. After 2030, Sasol expects zero emissions technologies to become increasingly significant as it looks to transition from gas to entirely renewable power-to-chemicals and power-to-liquids (PTL) processes.

Sasol president and chief executive Fleetwood Grobler said the group had a big advantage in servicing the energy transition because existing assets and technology, in particular its Fischer-Tropsch (FT) processes, are feedstock agnostic, able to use coal, gas, biomass, water, carbon capture, or even – towards 2050 – direct air capture for its carbon and hydrogen sources. Sasol has entered a partnership with the Council for Geosciences to assess carbon capture and storage options. FT is a process to convert carbon monoxide and hydrogen into liquid hydrocarbons.

Hydrogen ambitions

Green hydrogen is a priority, where Sasol aims to leverage its existing grey hydrogen production equipment and experience. Mabelane said Sasol could be producing green hydrogen at a price of $2/kg by 2030, although this assumes a drop in the price of electrolysers and renewable energy supplied at a cost around $0.02/kWh, with a load factor between 30% and 50%.

Sasol hopes to begin exporting green hydrogen around 2030. It anticipates export potential in southern Africa of 2m-3m t/yr for heavy transport and 3m-5m t/yr for ammonia by 2050 (when the International Energy Agency forecasts global demand of 520m tons/yr). According to Mabelane, The Secunda plant could accommodate 1.5-2GW electrolyser capacity with minimal changes. At $0.01-0.02/kg, Grobler said green hydrogen could compete with coal as a feedstock. Sasol intends to transition to using green hydrogen for 10% of its hydrogen demand by 2030, around 40% by 2040, and 100% by 2050.

In a big step towards carbon neutrality, Sasol announced the formation of Sasol ecoFT, a new business which will focus on developing sustainable FT products. A key goal is to make headway in the sustainable aviation fuel (SAF) market, which Sasol believes will have 14,000 bbl/d demand in southern Africa by 2050, as well as providing 50%-75% of the aviation fuel used worldwide. Sasol is one of the few international firms that already produces a certified synthetic jet fuel. Nordic countries have announced SAF targets of 30% by 2030; the European Union has targets for 5% SAF blends by 2030 and 32% by 2040.

Vice president Sasol 2.0 transformation Marius Brand said that although hydroprocessed oils and fats (HEFA) were now the cheapest and most common SAF, there were significant limitations to the availability of biomass and feedstock crops, and the technology cannot entirely eliminate emissions. HEFA is expected to be limited to 10%-20% of total aviation fuel consumed by 2050 (around 25m t/yr). Sasol’s PTL approach can meet a much higher demand and, at least in theory, without any GHG emissions.

Sasol intends to invest in pilot and demonstration projects in the period to 2025, co-investing in power-to-x ventures to gain experience of the technology.

It plans to fund transformation primarily with its own resources, although renewable power will be financed by IPPs. Sasol says it will invest R20bn-25bn/yr in its capital base until 2030, mostly to maintain its existing assets but with a peak investment in transformation around 2025 on current plans. Sasol aims to reduce its net debt to less than $4bn and is prioritising investing in the company transformation and restoring its dividend.

Group chief financial officer Paul Victor said Sasol didn’t expect a trade-off between cashflow and investment in the energy transformation. The company is focusing on easy wins with strong margins while it consolidates its balance sheet. There is “no tension between planet and profit”, Victor said. There would be modest investment to 2025, with the possibility of more substantial projects thereafter, when more cashflow was available.

The political centre of gravity is shifting away from coal-fired plants in South Africa and Eskom hopes to use the run-in to the COP26 climate change conference in November to generate interest in its plan to retire some plants early, but much remains to be resolved if its ambitions are to be realised... read more in this article's companion piece here.