Nigeria: Gas supply failures undermine generation ambitions

Issue 334

- 10 Nov 2016

| 4 minute read

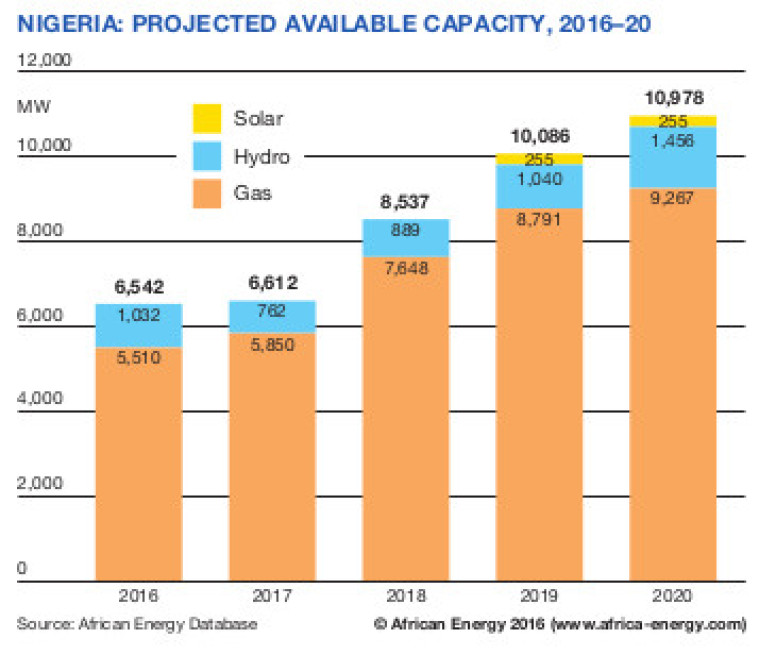

A financial crisis is undermining the Nigerian electricity supply industry (ESI), but just as important is the lack of natural gas to generate power, as potential suppliers have ducked calls for much-increased supply to the domestic industry while purchase prices remain low and cost-reflective tariffs are elusive. Lack of gas is compromising efforts to increase generated electricity output, shown in African Energy’s analysis of available data and forecasts based on research for the African Energy Database.

This article is available to registered users

Login

Don't have an account?

Register for access to our free content

An account also allows you to view selected free articles, set up news alerts,

search our African Energy Live Data power projects database and view project locations on our interactive map

Register